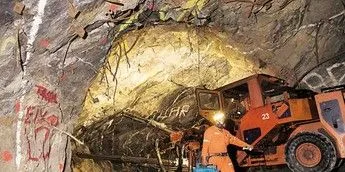

Mali's court-appointed administrator for the disputed Loulo-Gounkoto gold complex has moved to sell one metric ton of gold, valued at over $100 million (according to Daily Metal Price), that was previously seized from the site owned by Canadian mining firm Barrick Gold.

The sale comes as operations resume at the mine, which had been suspended for nearly six months following a dispute between Barrick and the Malian government.

According to sources cited by Reuters, the decision to proceed with the gold sale was made by the government-appointed administrator as part of efforts to reassert control over the site and address mounting fiscal pressures.

The proceeds, estimated at around $107 million, are expected to be used to cover operational costs including staff salaries, fuel, and outstanding payments owed to contractors.

Barrick, which has strongly opposed the government's actions, responded to the development by stating it had only received informal information regarding the reported restart and intended sale.

"If it is true, any plans by the administrator to restart operations and sell gold on the site, in our view, would be illegitimate," Barrick CEO Mark Bristow told Reuters.

The company said it is seeking to resolve the dispute through legal and diplomatic means.

"We will use every legal measure at our disposal to hold the state and the individuals involved accountable for these unlawful actions to protect our people and to defend our investments," Bristow said

Mali's fallout with foreign mining operators

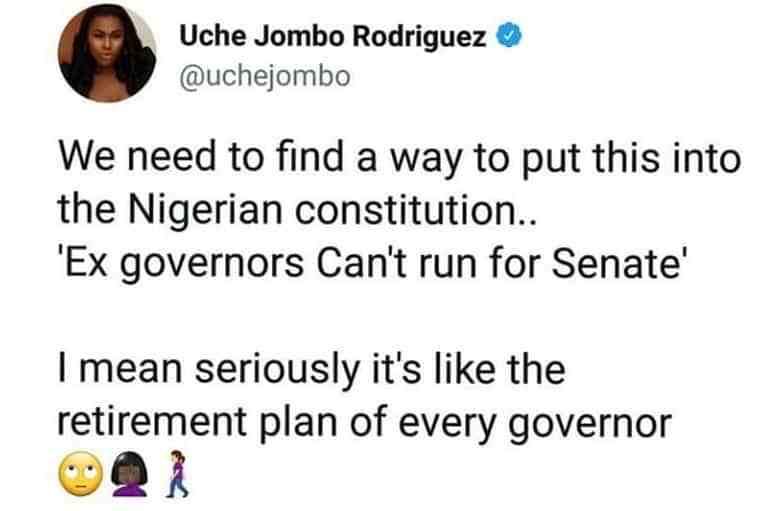

In recent years, Mali's transitional military-led government has moved to tighten control over the country's mining sector, citing goals of resource sovereignty and domestic development.

These efforts have included amendments to the mining code, demands for increased state ownership in projects, and delays in permit renewals, steps that have raised concerns among foreign investors, who view them as unilateral and destabilizing.

Tensions escalated in January 2025 when Barrick Gold halted operations at its Loulo-Gounkoto complex after the Malian government seized gold stocks stored at the site. Operated by the Canadian firm's local subsidiary, Loulo-Gounkoto is one of Mali's most productive gold mines and a key contributor to national export revenues.

Prior to the suspension, it accounted for roughly 15% of Barrick's total gold output.

The shutdown not only disrupted Mali's gold production but also highlighted a deepening rift between the state and international mining operators.

It reflects broader uncertainty in Mali's extractive sector, where military-led governance and rising economic nationalism are straining investor confidence.

Comments