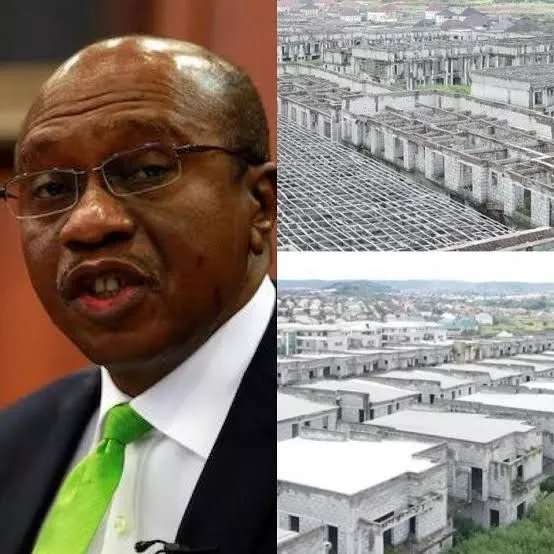

The federal government has been asked to seize two Nigerian banks sold during Godwin Emefiele's tenure as Governor of the Central Bank of Nigeria.

The banks are Union Bank of Nigeria and Keystone Bank.

The decision comes after nearly six months of a probe into the activities of the CBN under Emefiele by a special investigator, Jim Obazee, appointed by President Bola Tinubu, alleged gross corruption.

According to the report submitted to the president, it was revealed that the two banks were sold without due process. Therefore, the investigator recommended that the federal government seize and nationalise the two banks.

Union Bank acquisition

According to the investigator, while Union Banks mysterious shareholder is said to be domiciled in the United Arab Emirates, fact findings show they have no physical presence in Dubai as claimed.

Part of the report reads: "When we carried out investigation, we discovered that some persons were used as proxies by Mr. Godwin Emefiele to set up Titan Trust Bank and acquired Union Bank therefrom.

All from ill-gotten wealth." "It was found that these entities do not have physical presence in Dubai as claimed. This contravenes Section 3 (5) of the Banks and Other financial Institutions Act, 2020. Accordingly, they are not supposed to be allowed to operate or acquire a bank in Nigeria."

Keystone bank acquisition

The investigator also revealed how Keystone was "acquired for free." According to the report, despite the complete takeover of Keystone, there was no evidence of payment for the bank's acquisition.

A part of the report reads: "Some persons were used as proxies with the connivance and assistance of Mr. Godwin Emefiele and the CBN to acquire the two banks. "When we carried out investigation, we discovered that some persons were used as proxies with the connivance and assistance of Mr. Godwin Emefiele and the CBN to acquire Keystone Bank without evidence of payment."

More details on the Keystone Bank acquisition

Providing more details on the acquisition of Keystone Bank, the investigator said the managing director (MD) of the Asset Management Corporation of Nigeria (AMCOM) moved "N20 billion to Heritage Bank as placement sometime in 2017". Subsequently, Heritage Bank granted a N25 billion loan to ISA FUNTUA/EMEFIELE GROUP for acquiring Keystone Bank, using the bank's shares as collateral.

When the loan matured and the borrowers failed to repay, Heritage Bank demanded repayment, threatening to take over Keystone Bank based on the pledged shares.

Under pressure, Keystone Bank created internal loans totalling about N50 billion between June and October 2019 to repay Heritage Bank on behalf of the shareholders.

This was instigated by the managing director of Heritage Bank, backed by Emefiele's influence, causing the resignations of Keystone Bank's MDs who resisted the pressure.

Despite these resignations, the loan was ultimately approved by the GMs of Risk Management and Corporate Banking at Keystone Bank, and the funds were redirected to Heritage Bank to settle the shareholders' debts.

Comments