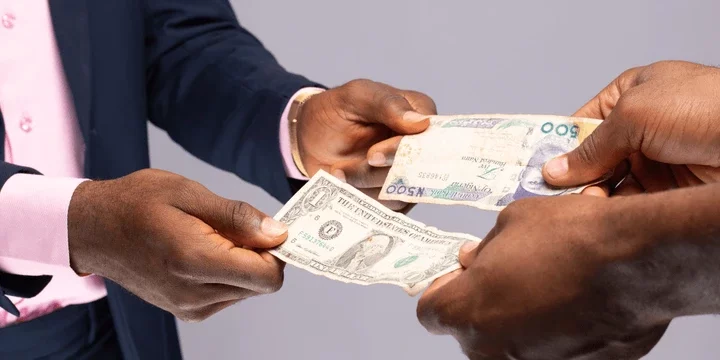

Two months have passed since the CBN announced its decision to float the naira in a bid to unify the country's exchange rates. Some Nigerians expected doom, others expected a turnaround. As the value of the naira has continued to plummet for the many Nigerians who patronize the black market, we can finally admit that the cynicism was warranted.

Many predictions were made, but still, nobody seemed to have predicted the speed and degree of the naira's decline.

Predictions Vs. Reality

The CBN policy was supposed to be a signal to local, and, especially, foreign investors that Nigeria was productive enough for their funds. The intentions were good, if only because the initial expectation was that foreign investors would see the Nigerian market as viable, which would spur a substantial inflow of dollars via various investments.

This inflow, as the theory goes, would help meet the national demand for dollars, thereby depleting the backlog of forex applications at banks across the country. With this reduction in demand, the naira would stand a better chance at competing against the dollar. The hope was simple: even if the famed days of the dollar being equal to the naira are long past, maybe a little reversal was possible.

That hasn't quite happened. Several Nigerians, like the economist Marcel Okeke, broached the subject with the appropriate level of cynicism at the time. He pointed out that "the economy is a system and whimsically picking parts of the system without a thorough consideration of the interconnectedness of the blueprint's parts usually leads to unintended/suboptimal results."

Well, in less than a quarter, the population is experiencing those suboptimal results.

A large part of the problem is that Nigeria is heavily reliant on imports, which means that prices of consumer goods have continued to rise following the announcement. Limits on naira debit cards have been lifted, but it's only been a blip in the overall economic picture.

With the price of $1 surging past ₦800 and then ₦900 in the more readily available black market, some have wondered if it is only a matter of time before the hitherto unthinkable ₦1,000 to a dollar will be reached.

What should Nigerians expect?

Already, on X, the platform formerly known as Twitter, posts on the subject have gone viral. If $1 gets to ₦1,000, one user posted, "that means the minimum wage of ₦30,000 is $30. It effectively means if someone works for a month on minimum wage, [such a person is] actually working for $1 per day."

It is alarming, but the math's in that post is valid: Workers earning ₦30,000, the national minimum wage, will effectively be working for their daily dollar if the exchange rate reaches ₦1,000. In other words, Nigerian workers in that category will unambiguously be living in poverty, going by the UN's definition, as the global body sets $2 as the upper income limit in defining poverty.

But the Nigerian situation might be even worse because the UN also states that, "Of those living in poverty, over 800 million people live in extreme poverty, surviving on less than US $1.25 a day."

This suggests that at ₦1,000 to $1, a large segment of the Nigerian population would instantly be plunged into extreme poverty. That the official exchange rate might witness a less dramatic rise would offer little relief, as many imported goods sold in the Nigerian market are pegged to what is obtainable on the black market.

For students heading to school overseas and paying their own fees in dollars (or even pounds), a hard task has been made harder. Even if their fees remain unchanged in dollars, they will need to raise and/or save more naira. A tuition fee of $10,000 would require ₦10,000,000, which represents an extra ₦2,000,000, if the old exchange rate is ₦800 to a dollar.

The financial impact would be brutal for parents earning in naira and paying tuition fees for more than one child schooling abroad.

Businesses dealing in imported items would need to buy items by paying more naira. But that may only be half the problem since they would also need to sell to customers not quite prepared to pay new, higher prices.

Will the government intervene?

Although floating the naira is still a relatively new policy, it seems inevitable that the government will have to intervene. Already, the CBN has expressed a desire to step in and the forex market has responded. Following the apex bank's public indication of interest in the situation, the naira went from around ₦935 to ₦880 in the black market. The official rate is still below ₦800.

And yet, there is a genuine worry that this intervention is doomed to be a temporary solution because it still isn't clear that the country has received an inflow of dollars to meet ongoing demand from individuals and businesses. But many would welcome the relief, even if they know that the sole long-term solution would require the country to produce a sizeable number of items for exportation.

Comments