Money Saving Tips: Every salaried employee, student, married person, and unmarried person values saving money. notably those who are nearing retirement or who are making significant future plans. Saving money is one method to start planning for the future. Out of every five unsuccessful persons, four attribute their bad luck to their unwillingness to save. Due to the realigning invasion of personal obligations, the majority of wage workers find it extremely difficult to save.

Money Saving Tips: 16 Ways on How to Save Money from Salary Every Month.

Every salary earner needs to know money saving tips. A student needs to know money saving tips, anyone who desires to succeed by saving more needs this money saving tips,

Maybe you are not saving your money as you receive your salary. Probably your salary does not satisfy you, because you are earning a meager salary, Below here are 25 ways on how to save money from salary every month.

Escape debt

In case you're just earning a minimum wage, you can't stand to send cash to an auto financing organization or charge card organization.

Consider it this way: If you had no house bills, no car installment and no Mastercard fee, what's now left out? The main month to month costs you may need to cover would be utilities, insurance, fuel and nourishment. In numerous countries of the world, you could do that on $15,000 a year.

We'll talk somewhat more about easily affordable housing alternatives in a moment, yet to everything else in your life, try to be free from debt.

2. Make a budget

Make your financial plan which will serve as your budget. Begin with your common net month to month income, which is your paycheck after recording taxes. In the first place, deducts your fixed expenses. At that point, figure out what 10 percent of your net salary is. This ought to be your base objective to spare each month. Subtract that number from what's left of your paycheck. The last sum is the thing that you will take a shot at to make sense of a financial plan.

Do you have enough cash after bills and investment funds to cover your average ways of managing money? If not, diminish your expenses. In your budget, consider flexible wants first, before considering other areas

On the other side, if you don't have a fixed salary, you can start from the normal salary earn in the last six months.

On the off chance that you salary is sporadic, for example, most retail laborers who don't more often than not have settled calendars, begin with a normal of the last six to twelve months.

3. Stick to your budget

After you have made your budget, it is very important that you stick to your budget. It is very common for people to spend loquaciously without giving a thought at the budget which they had set aside. Sticking to your budget will help you to control the level of waste because you will be spending your money according to how you planned it. This is one way to save money even as a salary earner.

4. Make smart use of any extra cash you get.

You can gets extra income from gifts of money, tax refunds and other windfalls.

For example, if you earn a meager salary and have children, chances are you're entitled to the Earned Income Tax Credit. That could mean you get thousands of dollars from Uncle Sam every year.

Until you get on firm money related ground, fight the temptation to spend windfalls. Put two or three hundred dollars in the bank as a backup stash and ship the rest off to your lenders. In case you're not owing a debt, save at any rate half of the fortune gotten before you consider spending a penny.

5. Reduce monthly Bills

Evaluate all your monthly bills to know where you have been spending know where you have been spending unnecessarily. Eliminate bills that may seem useless. Take for example you are living alone and you spend a good number of your time in the office, a having a T.v satellite subscription might be unimportant considering the limited time you spend at home.

Look out for unnecessary bills and try not to pay for it, you will realize how much you will be able to sae for the months.

6 Save your pennies and change

Begin a change container and put your coins into it consistently. Toward the finish of the month, move up the coins and place them in a bank account.

Wow fantastic !

The truth is that you won't retire from your service rich off the cash you gather, however you could wind up with $10 or $20 a month to cushion your bank account. That is not much, but rather when you're making $7.25 60 minutes, each and every piece makes a difference.

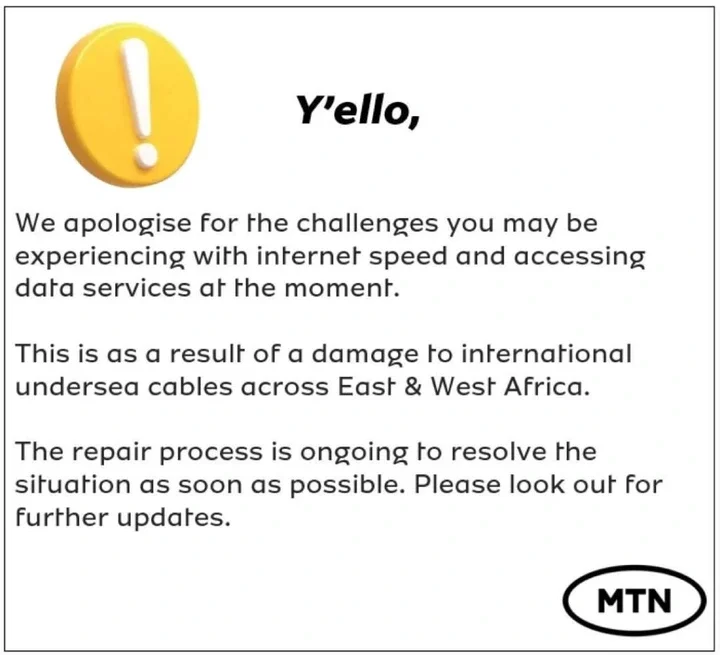

7. Spend less on social network

The social media is one medium that has stolen the time as well as the finances of most young people and salary earners. It is often said that time is precious and time is money. One way to save money from your salary is for you to reduce the time and the money spent on the social media. Addiction to social media can cause one so much of the monthly data subscription to remain on the social media and this is another expenses.

8. Avoid Junk foods

Junk foods are frequently unhealthful. You will feel healthy and better, reducing spending on health services over a long run on the off chance that you say farewell to boxed diets and frozen dinners.

In the case that you requiring some menu motivation, look at spending cookbooks from your neighborhood library. Ore better still meet a cook for a food menu

9. Sell out old stuffs

Look at your old possessions and consider offering for sale the things you do not need anymore or utilize. Offer first-class things like furniture as opposed to discarding them when you fix up a new one.

Sell out smaller and effectively dispatched merchandise through online shops or closeout destinations. Attempt to offer vast, massive or exceptionally modest things locally. Keep in mind that your time in significant, and it may not be justified regardless of the exertion of posting a posting and mailing something that offers for a dollar.

On the other side, if you can pretend not to notice any extra income generated from the selling of unused items, fine. Imagine this extra income doesn't exist. Rather than considering it into your monthly budget, put the vast amount of your additional pay into your savings.

10. Save money by parking the car

Maintaining a car might be one parasite eating your money because you actually pay for insurance, registration and fuel. This is worst if it is actually a loan car because you really have to be paying to the car company monthly.

You will save a lot of money if you can just park your car for just a while or driving it less frequently, depending on your journey and the circumstances, you might just chose to:

utilize the public transportation.

Sell out one of your vehicle, in case you're operating a family with two cars.

Sell your costly car and purchase a less expensive one.

Carpool with a collaborator or companion and share the car costs.

Combine errands and arrangements to reduce fuel costs.

8. Have a saving account

Your saving account will be the best place to drop money. Your saving is of utmost important to you. Remember that Your target is to save money from your little salary earned every months. Having a A saving account will help you to save your little money gotten from, your pennies, selling old stuffs etc. This money saving tips will help you to do more savings.

One of the ways to save your money from your salary is for you to shave part of of your salary into your savings account. Review your saving account annually or bi-annually and you will be surprise how much you have been able to save.

9. Buy Used stuff

Another money saving tips is to Buy Used stuffs. Instead of getting a brand new stuff, have you considered buying it fairly used? Fairly used stuffs will help you to save money from things which save the purpose of a new stuff. It is advisable to buy items like furniture, equipment, household items and kitchen utensils when buying old stuffs.

It is not advisable to buy electronics, gadget or even, machines, phones and phones accessories, when buying fairly used stuffs. The truth is that the machines electronics and phones may develop hidden fault that is why the owner has put it into market. Buying used stuffs will help you to save your money in a great way. there are numerous online shops which you can sell your old stuffs in Nigeria, you can sell with jiji.com.ng

10. Plan your meals, A great Money Saving tips

Remember not to eat junked or processed foods., but rather plan your meal weekly or monthly. Doing this has a great way of making you to save a lot from your salary. When you are spending on your meals, always bounce back to your budget and spend judiciously.

When you plan your meals you stay behind the restaurant and of course you know that the restaurant has a way of draining a person's money. One thing that has made most young people spend their money carelessly is the restaurant. Instead of visiting the restaurant every meal time, why don't you consider coking at home?

Yes! It will save your money

12. Plan before going shopping

Remember that your goal is to save money that is why you are reading this money saving tips.Before you go for shopping, make sure you plan in consonance with your spending budget. When going for shopping, decide on the actual amount to be spent and make sure you keep it small. Spending profusely can make you bankrupt and killed your savings account.

Before going to the mall or shopping center, endeavor to do listing of all the things you are to buy and make the expenditure moderate.

13. Do a side business, A good Money Saving tips

Take out time to do a site business maybe during break or when you are on your off duty. For example you can just start up a blog and do this while at home, on weekends or your spare time. You can help couple of people in your environment to carry out some duty and get paid. This is a good money saving tips

Aside from your salary, you can earn big by just putting your talent into work look into yourself and ask yourself what can I do that people can pay me for it? Maybe you know how to sing, do a compere or Dj work you can do this on birthdays and get paid. Or you are good in writing you can go into a freelance writing business and make some cool buks online.

14 Let out extra space or invite friend to squat with you

Do you live in a big outlet? Why waste it when you can just invite a friend to squat with you and get your pay. Or you just have many rooms in your house. Have you considered letting it out to your friends and get some extra money out of it.

In letting out extra space it is very important that you know the kind of person you are inviting to stay in your space. If you are letting out your house, consider inviting a trusted friend.

15. Consume less

This is another money saving tips, Maybe you are just like a glutton and consume more than a half of your salary on food. To save money you have to reduce the level of your consumption. May be you spend a lot of money on your meals, you can just replace that with your daily routine of cooking. Instead of consuming more, you should invest in consuming nutritional foods that will help you to stay healthy.

16. Stay Healthy

There is a popular saying " Health is wealth". One way of to get extra money and save more is to keep watch over your health. your health is of utmost important and you should not trade it for anything. Your health determines your ability to make wealth. Even when you are taking a site job, make sure it does not contrast to your health. Other money saving tips may not be as important as this one.

Comments